Canadians cannot afford to let their guard down when it comes to fraud prevention, according to a new survey conducted by Chartered Professional Accountants of Canada (CPA Canada).

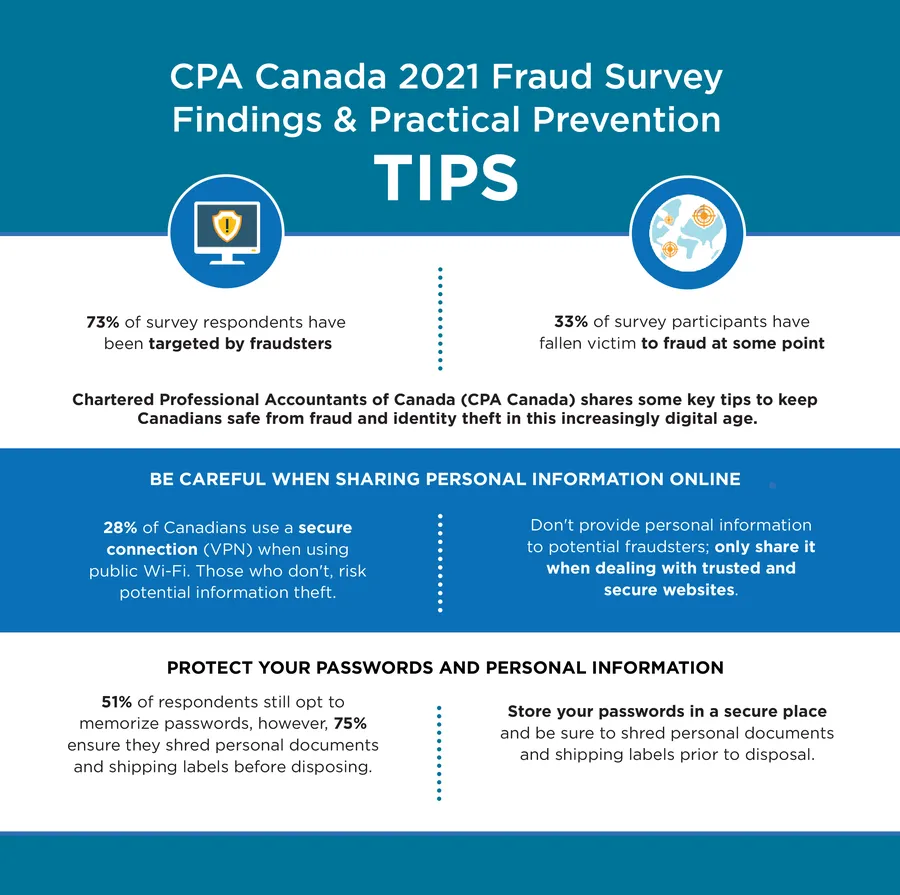

Almost three quarters of the individuals surveyed (73 per cent) reported having received fraudulent requests and one out of three (33 per cent) noted they had fallen victim to one or more types of fraud at some point in their lives. As we enter Fraud Prevention Month in March, the good news for Canadians is that 62 per cent are doing more to prevent themselves from being a victim of fraud than they were five years ago.

“Fraudsters are always looking for new ways to take advantage of unsuspecting Canadians, therefore, vigilance in protecting yourself is essential,” says Doretta Thompson, CPA Canada’s Financial Literacy Leader. “With our lives increasingly being lived online due to COVID-19’s new world, it’s more important than ever for Canadians to be diligent, on alert and safeguarding their private information.”

To help Canadians, CPA Canada offers its top fraud prevention tips:

Be careful when conducting online activities

According to the survey, more than half of respondents (52 per cent) are concerned about the online businesses they deal with being vulnerable to cyber-attacks. In cases where it’s necessary to provide personal information, it’s important to only do so on secure websites, which 70 per cent of respondents are already doing. An easy way to check if a website is secure is by looking for the padlock icon in your web browser – if it is locked, the website is secure.

Protect your passwords

Password protection remains an area for improvement for many Canadians, as 51 per cent of survey respondents opt to memorize their passwords. It’s important to store passwords in a secure place and to shred all documents containing personal information, which 75 per cent of the survey participants reported doing.

Do not respond to calls and texts from unrecognized numbers

Since telemarking fraud remains one of the most common types, it’s important to screen calls and texts from unknown numbers. According to the survey, 38 per cent of respondents reported answering calls from unrecognized numbers. Text messages are much easier to screen, with just over one in ten (11 per cent) respondents replying to texts from unknown numbers.

Monitor your credit card and banking transactions

It’s important to review and track your banking and credit card transactions at least once a month to monitor for illegitimate activities. While about eight in ten respondents (82 per cent) already review their transaction history on a monthly basis, only 39 per cent have set up text or email alerts for banking and credit card transactions, which can help them catch fraudulent activity right away.

Survey Methodology

Nielsen conducted the CPA Canada 2021 Annual Fraud Survey via an online questionnaire, from January 19 to 28, 2021, with 2,014 randomly selected Canadian adults, aged 18 years and over, who are members of their online panel. A background document can be found online at: cpacanada.ca/fraud2021.

About CPA Canada

Chartered Professional Accountants of Canada (CPA Canada) works collaboratively with the provincial, territorial and Bermudian CPA bodies, as it represents the Canadian accounting profession, both nationally and internationally. This collaboration allows the Canadian profession to champion best practices that benefit business and society, as well as prepare its members for an ever-evolving operating environment featuring unprecedented change. Representing more than 220,000 members, CPA Canada is one of the largest national accounting bodies worldwide. cpacanada.ca

Please contact us here to learn more about how we can help you craft meaningful campaigns that amplify your brand awareness and boost consumer loyalty.